Congress's ObamaCare Exemption

First, the White House ignored ObamaCare by suspending the employer mandate for a full year, delaying the employer mandate from going into effect on Jan. 1, 2014. Instead, the mandate kicks in on Jan. 1, 2015. How can they take the concrete "effective dates" and change them? They just do, because they just can.

Now we have Congress's ObamaCare Exemption. The Affordable Care Act requires Members of Congress and their staffs to participate in the health insurance exchanges. The reason? to gain firsthand experience with what they have imposed on their constituents. All good so far.

This amendment requiring Congress to participate in ObamaCare was passed in 2009 and the Finance Committee unanimously passed this rule. The chairman of the committee was pleased that Congress had so much confidence in ObamaCare that they are going to participate in it themselves! Still good so far.

Then they found out what they signed up for: A health insurance program for the unwashed masses (that's us, folks). Horrified that they were actually going to have to wallow around in the dirt with rest of us, they realized that this situation could not stand. A fix was needed to elevate themselves above the lowly taxpayer. Thus, another (illegal?) exception to ObamaCare was carved out, this time for themselves and their staffs.The bottom line: Congress and their staffs will receive (illegal?) extra payments from the Federal Employees Health Benefits Program (FEHBP) that will run between $5,000 and $10,000 per person or family. Will we get these same perks? Not in your wildest dreams! Its good to be the King! Read more here. FactCheck.org seems to say otherwise, but the claim here is that Congress will receive extra payments from FEHBP to compensate for additional costs associated with being enrolled in ObamaCare - something that FactCheck.org does not address. This may have to play out a little longer for us to find out what is really going on - if we ever do. Read what FactCheck.org says on this subjecthere. Look for an update here once we find out more. Stay tuned.

*****Update 2013/07/18

Dr. Kline Brings His Wisdom to Washington - Hope Somebody is Listening, Ron!

*****Update 2013/07/17

ObamaCare Adds a New Tax and a New Tax Form for Employers

I just received this in the mail yesterday: More fees and paperwork, attributed by my 105 Plan Administrators (AgriPlan BizPlan) to the passage of ObamaCare. They inform me that the burden of complying with ObamaCare is being placed on me, the employer. ObamaCare is collecting a fee from me, the employer, to pay the Patient-Centered Outcomes Research Institute (PCORI). The fees paid to PCORI go towards examining various medical treatment outcomes. The fees are due by 7/31/2013.

*****Update 2013/07/03

ObamaCare Delayed for Employers with 50 or More Employees from 2014 to 2015

Right before the major 4th of July holiday weekend (while Congress was in recess), a minor Treasury Department official casually posted on their web site that the Employer Mandate (this type of move is called in Washington DC "taking out the trash"), a key provision of the Affordable Care Act, would be delayed for a year. Note that this moved the provision past the 2014 midterm elections, and presumably delays the harm to the election results for the Dems.

Obama officials tried to pin the delay on businesses not being ready - leaving out the fact that they weren't ready only because the final rules had not yet been published by the Obama administration. This, despite the fact that only 6 months remained until implementation of ObamaCare, which was passed into law way back in 2010. They've had 3+ years to come up with some understandable rules for businesses, and they have not been able to do that, it would seem.

Let's hear from the Left: A quote from the Huffington Post Article that explains this delay (17,000+ comments on this article!):

*****Update 2013/06/10

The Strategic EMPLOYER newsletter, December 2012, page 3 -7. See the Waag and Co. Employment Law web site for more information. If you can understand ObamaCare, then you are way ahead of me.

by Kenneth W. Ruthenberg, Jr.

This health care legislation is complex and not yet fully defined and understood, and compliance with it will be a challenge for many employers.

As an employment law firm that does not give direct advice on ObamaCare compliance issues, Waag and Co. turned to an expert attorney in the field of health care law related to employers: Kenneth W. Ruthenberg, Jr., Esq. of the law firm Chang, Ruthenberg & Long. Mr. Ruthenberg was kind enough to pen this article to assist our clients in understanding where to begin in managing the requirements of ObamaCare and how to plan as we go forward into 2013, 2014 and beyond.

We recommend that employers seek out advice from qualified legal counsel such as Mr. Ruthenberg to understand ObamaCare and determine the best way to meet the needs of their business while complying with the law.

Once that is determined, Waag and Co., as always, is ready and available to assist employers with employment law issues that may be related to implementing your ObamaCare strategy, such as staffing levels, temp agency staffing, labor contracting, wage and hour laws, etc. We hope that Mr. Ruthenberg’s article below will provide a helpful start to your planning process.

Introduction

This article presents an overview of some of the more important issues that employers should have already addressed, ought to be addressing at this time, and will need to address in the years to come.

Small Employer Tax Credit

Over-The-Counter and Prescription Drugs

Effective for taxable years beginning after December 31, 2012, an employer is not able to deduct prescription drug expenses to the extent that the employer receives a subsidy under the Social Security Act that is not included in the employer's gross income because the employer has a “qualified retiree prescription drug plan.”

Prior to health care reform, such an employer was able to receive the tax-free subsidy and claim an income tax deduction for the prescription drug expenses.

Cafeteria Plans

Effective for plan years beginning after December 31, 2012, a cafeteria plan offering a health flexible spending arrangement (“FSA”) must provide that an employee may not elect (for any plan year) to have salary reduction contributions to the FSA in excess of $2,500 (as adjusted for inflation).

Form W-2 Reporting

However, reporting for an employer that files fewer than 250 Forms W-2 for the previous calendar year is not required until further notice from the IRS. Although each employer should review the reporting guidance that can be found on the IRS's web site at www.irs.gov/uac/Form-W-2-Reporting-of-Employer-Sponsored-Health-Coverage, employers should note that:

• The most common types of coverage that must be reported are major medical coverage, the employer's portion of a health FSA, and dental coverage and vision coverage if they are not excepted from the reporting requirement (see next bullet).

• The most common types of coverage that need not be reported are the employees' compensation reduction portion of a health FSA, dental coverage and vision coverage if:

(i) they are under separate insurance policies if they are fully insured, or

(ii) if they are self-insured, participants are able to elect the coverage separately from the major medical benefits and pay an additional premium for the dental and vision coverage, and employer contributions to health savings accounts (“HSA”s).

• The cost of the coverage includes both employer and employee contributions and is determined using one of three methods:

(i) the COBRA applicable premium method,

(ii) the premium charged method for insured plans, or

(iii) the modified COBRA premium method.

• Just because an amount is reported on Form W-2 does not mean that the amount is taxable to the employee —these benefits can generally be provided on a tax-free basis — this reporting is for informational purposes only.

Medical Loss Ratio (“MLR”) Rebates

The failure to use an MLR rebate as required could result in adverse consequences to the policyholder and the group health plan's fiduciaries. The employer must also consider the tax consequences of the rebate for itself and for each employee, and comply with the applicable tax reporting requirements.

Group Health Plan Coverage Requirements

They also contain a number of prohibitions. For example, they prohibit pre-existing condition exclusions and lifetime / annual limits on essential health benefits, as well as discrimination by fully-insured group health plans in favor of highly compensated employees. These nondiscrimination rules are based on the existing nondiscrimination rules for medical expense reimbursements that are not fully insured. However, the government has put these new nondiscrimination rules on hold pending the issuance of guidance telling us how the new rules are going to work.

It is possible that not all of an employer's health plans are subject to these rules. For example, “grandfathered” group health plans —those that existed on March 23, 2010 and satisfy certain other requirements — are not subject to some of these rules. Also, certain stand-alone dental and vision benefits and retiree-only health plans escape some of the rules.

It is important for each employer to determine which plans are subject to the new rules and to make sure that each such plan complies with them. Employers are subject to penalties if their group health plans violate the new laws.

Additional Medicare Taxes

The employer is responsible for withholding the additional 0.9% on wages in excess of $200,000 only. Note that “wages” means “all remuneration for employment” unless specifically excepted under the Internal Revenue Service Code, including “wages” not received in cash (e.g., certain noncash fringe benefits, group-term life insurance in excess of $50,000, and amounts deferred under a nonqualified deferred compensation plan).

Exchanges

What is an exchange? An exchange is an entity established by a State or the federal government to help individuals and certain employers purchase health insurance coverage, as well as perform a number of other functions under the health care reform laws.

(i) informs the employee of the existence of a health insurance exchange, where health insurance coverage can be purchased, including a description of the services provided by the exchange, and the manner in which the employee may contact the exchange to request assistance; (ii) alerts the employee to the possibility of eligibility for a premium tax credit or a cost-sharing reduction if the employee purchases a qualified health plan through the exchange and the employer plan's share of the total cost of benefits under the plan is less than 60%; and (iii) explains that an employee who purchases a qualified health plan through the exchange may lose the employer contribution (if any) to any health benefits plan offered by the employer and that all or a portion of such contribution may be excludable from the employee's income for federal income tax purposes. The employer must then also provide the notice to new employees at the time of hiring.

Beginning in 2014, a small employer can offer coverage through an exchange. An employer is a small employer if the employer employed an average of not more than 100 employees (50 employees if the State changes the definition) on business days during the preceding calendar year.

Beginning in 2017, a large employer can offer coverage through an exchange. An employer is a large employer if the employer employed an average of at least 101 employees (51 employees if the State changes the definition) on business days during the preceding calendar year. If an employer offers coverage through an exchange, the employees can use the employer's cafeteria plan to pay exchange premiums.

“Play or Pay” Penalty

Who is a large employer? An employer is a large employer for a year if the employer employed an average of at least 50 full-time employees (at least 30 hours per week) on business days during the preceding calendar year. In order to make this determination, the employer must not only count all of its full-time employees, it must count the hours worked by its part-time employees for each month and divide this total by 120 in order to determine its “full-time equivalent” employees for the month.

An employer that has “seasonal workers” may be able to use a special rule for avoiding large employer status. It provides that an employer is not considered to employ more than 50 full-time employees if: (i) the employer's workforce exceeds 50 full-time employees for no more than 120 days during the calendar year; and (ii) the employees in excess of 50 employed during that 120-day period were “seasonal workers.”

What is a “seasonal worker”? A “seasonal worker” is a worker who performs labor or services on a seasonal basis as defined by the Secretary of Labor. They include workers whose employment pertains to or is of the kind exclusively performed at certain seasons or periods of the year and that may not be continuous or carried on throughout the year. They also include retail workers employed exclusively during holiday seasons. A reasonable, good faith interpretation of who is “seasonal” is all that is required through at least 2014.

The IRS has provided detailed guidance and safe harbor methods for counting employees. The guidance includes the use of measurement periods for making “full-time employee” determinations, stability periods for using the results from a measurement period without having to reexamine employees whose hours might have changed, and the treatment of new employees. See IRS Notice 2012-58 at www.irs.gov/uac/Affordable-Care-Act-Tax-Provisions.

What coverage must the employer offer? The employer's coverage must be affordable to the employees and provide minimum value to the employees:

• A group health plan is not affordable if the employee's self-only coverage premium exceeds 9.5% of the employee's household income (the percentage will be indexed for inflation). An employer cannot make this determination without knowing a great deal of financial information about its employees. The penalty provision is structured so that this determination is made by the U.S. Department of Health and Human Services (“HHS”) or an exchange in cooperation with HHS.

• A group health plan does not provide minimum value if the plan's share of the total allowed costs of benefits provided under the plan is less than 60%. We are awaiting guidance from the government on how to make this determination.

The IRS has mentioned the HHS's creation of a calculator, the use of design-based safe harbor checklists, and an actuary's certification. Pending additional guidance, employers should work with their group health plan advisors to determine if this requirement is satisfied by their group health plans.

When is the penalty triggered? The penalty is triggered if, and only if, HHS or an exchange in cooperation with HHS has certified to the employer that at least one full-time employee has enrolled in an exchange with respect to which a tax credit or cost-sharing reduction is allowed or paid with respect to the employee.

That is, because either:

(i) the employer did not offer minimum essential coverage to its full-time employees (need not offer such coverage to the part-time employees); or

(ii) the coverage offered was not affordable or did not provide minimum value.

Note that an employee who enrolls in an employer's group health plan has minimum essential health coverage and is not eligible for the premium assistance credit, even if the plan is not affordable or does not provide minimum value.

What is the penalty? It depends on the failure involved. If a large employer fails to offer all (or substantially all) full-time employees the opportunity to enroll in minimum essential health coverage under an eligible employer-sponsored plan for a month, the penalty for that month is equal to the product of the number of full-time employees for the month minus 30 x $2,000 x 1/12.

If, however, a large employer offers full-time employees the opportunity to enroll in minimum essential health coverage for a month but the coverage is not affordable or does not provide minimum value, the penalty for that month is equal to the product of the number of full-time employees for the month who have been certified by HHS x $3,000 x 1/12, not to exceed the penalty that would have applied if the employer had not offered minimum essential health coverage under an eligible employer-sponsored plan (above).

Automatic Enrollment

The employer or the administrator must also provide adequate notice to the employees of such automatic enrollment and the opportunity for an employee to opt out of any coverage in which the employee was automatically enrolled.

We are currently awaiting guidance from the DOL on this new requirement, including when it will become effective (likely in 2014). We will also have to see how this new requirement meshes with the cafeteria plan rules under the IRS Code.

Cadillac Tax

What To Do Now?

Because of the complexities presented by health care reform laws, we encourage employers to seek advice from an attorney who is knowledgeable about the new laws. Employers should also be on the watch for additional guidance from the government about what the new laws mean and how to comply with them.

*****Update 2013/06/08 - Money Magazine (July 2013 edition) reports on page 15 that a recent John Hopkins study shows that if doctors are shown the bill for medical tests that they order, they will then order 9.6% less tests. However, the reality is that doctors are NOT shown the costs for the tests, because nobody even knows how much they cost - including the doctors and hospitals! Information leads providers to be more cost-conscious.

We've always objected to how the medical system deals in Funny Money, and is separated from economic reality by providers and users. This study is a great example of that. By the way, I went online and could NOT find that study...go figure!

*****Update 2013/05/30: - Just got this letter from Blue Shield in the mail today. It explains 2 ObamaCare taxes that I had never heard of before, even though I have edited numerous articles for law firm newsletters on the subject. The 2 new taxes are:

*****Update 2013/05/29 (The Strategic EMPLOYER newsletter, December 2012, page 1)

By Tim Waag.

Not being health care benefit experts, Waag and Co. is just as anxious as our clients and friends when it comes to understanding what ObamaCare may be foisting upon us. The legislation underlying the mandates is complex, technical, and often obscure. This newsletter, unfortunately, is only able to serve as a starting point for helping you and your business to sort it out.

A less talked-about change of dynamics for 2013 has to do with our new Democrat supermajority in the California state Legislature. Democrats have unrestricted, unchecked power in the executive and the legislative branch, and all the responsibility (and blame) that goes with it.

Since it takes two-thirds of the California Legislature to enact a variety of important legislation, the Republicans have for years been able to easily frustrate Democrat ambitions. With Democrat victories in the November 2012 election, there is now an unfettered shift in power.

Many expect a full-out assault on the taxpayers of California, while others hope that restraint is the order of the day. Either way, Democrats will own 100% of whatever direction is taken.

Democrat leaders are facing years of pent-up desire among their grassroots supporters to roll back spending cuts, rebuild the state’s water system, amend the state’s tax code, revamp California’s governance system and more. We’ll just have to wait and see what happens. It should be an interesting year for California businesses.

*****Original Article - I've been discussing ObamaCare recently with friends. Below are a few notes from that discussion, followed by an article that appeared in the newsletter, The Strategic EMPLOYER. As with most contentious issues, we are discussing not certainty of outcome, but likelihood of outcome, if you can appreciate the difference. I am confused as to how insurers can come up with rates effective 1/1/2014, when it there is 7 more months of historical data to precede that date (see this Forbes article on the subject). We usually get our new health care rates shortly before they renew. Of course, time will tell, and it just feels like a crap-shoot to us.

I believe that ObamaCare may just be a clever precursor to a Single Payer System, which, believe or not, I favor over ObamaCare by a wide margin. Single payer can be implemented in many different ways, so it would depend on the details of implementation as to whether I'd like it or not. The main reason is that Single Payer has one thing that ObamaCare does not - understandability and simplicity. The reason that "no one really knows what is going to happen to costs, they're all SWAGs" should scare us, not encourage us - since we are talking about health care making up about one sixth of the national GDP! Single payer is an incredibly simpler system, and one assumes that it would also be easier to estimate those costs to the US citizens.

I actually believe that health care should be disconnected from employment - the reasons are obvious. Employers got into health care during the wage freezes of WW II, as it was a way to increase pay during the freeze. Its been connected to employment ever since. Decoupling health care from employment makes sense to me, but will never ever happen, of course (because it makes too much sense). People buy most insurance themselves (auto, life, disability, homeowner's, umbrella, diver's alert network scuba insurance, renter's, business liability, malpractice insurance, etc.), so why not health insurance? Yes, I know that employers offer token life and disability insurance and perhaps other insurance, but only token coverage - not all that is required. That way, your health insurance goes with you no matter where you work - you can change jobs because quality health insurance does not force you to stay where you are.

A friend writes:

"Honestly, no one really knows what is going to happen to costs, they're all SWAGs. That's why the Forbes article [see above link - same as this link] was so interesting to me, it is the first real life example of what is starting to happen (as opposed to all of the predictions from the talking heads). Health care costs have been rising at 5-10% per year for more than a decade, so I'm not sure that we can blame cost increases on the ACA.

The ACA hopes to "bend the cost curve" but I think we're several years from that, and that is the part that I am most skeptical about. We haven't yet made the hard decisions that result in costs going down. Right now, we are expanding coverage, putting much needed restrictions on insurance companies, and providing mechanisms like the exchange (Covered California) to make the market more efficient.

Although we may disagree, I have no problems with giving employers carrots and sticks to expand employee health coverage. Employer based health coverage is the legacy that we have from World War II, so we either replace it, or make it work better. The replacement would likely be a government run single payer health system, so I'm not sure that you would like that any better (nor would I).

Finally, there will be many, many plans on the exchange. The three plans (actually four) that you found are referred to as "metal tiers" They are platinum, gold, silver and bronze and actuarially are required to pay for 90, 80, 70 and 60% of antcipated costs respectively, Within each of those tiers, there will be many different plans from different insurance companies offering many permutations of co-pays, co-insurance, and variable coverage for drugs, outpatient care, and hospitalization that you will choose to suit your needs best.

The metals tiers are only there to provide "transparency" so that you can better compare plans The federal government will provide decreasing subsidies up to four times the federal poverty level, which is currently $90K for a family of four."

This amendment requiring Congress to participate in ObamaCare was passed in 2009 and the Finance Committee unanimously passed this rule. The chairman of the committee was pleased that Congress had so much confidence in ObamaCare that they are going to participate in it themselves! Still good so far.

Then they found out what they signed up for: A health insurance program for the unwashed masses (that's us, folks). Horrified that they were actually going to have to wallow around in the dirt with rest of us, they realized that this situation could not stand. A fix was needed to elevate themselves above the lowly taxpayer. Thus, another (illegal?) exception to ObamaCare was carved out, this time for themselves and their staffs.The bottom line: Congress and their staffs will receive (illegal?) extra payments from the Federal Employees Health Benefits Program (FEHBP) that will run between $5,000 and $10,000 per person or family. Will we get these same perks? Not in your wildest dreams! Its good to be the King! Read more here. FactCheck.org seems to say otherwise, but the claim here is that Congress will receive extra payments from FEHBP to compensate for additional costs associated with being enrolled in ObamaCare - something that FactCheck.org does not address. This may have to play out a little longer for us to find out what is really going on - if we ever do. Read what FactCheck.org says on this subjecthere. Look for an update here once we find out more. Stay tuned.

*****Update 2013/07/18

Dr. Kline Brings His Wisdom to Washington - Hope Somebody is Listening, Ron!

Above (click to enlarge and be able to read): Article from the Las Vegas Review-Journal. On a personal note: our longtime friend from the UCLA undergrad days is heading to Washington. We hope he has a chance to make a positive impact on the various issues surrounding health care in America. Congratulations and Good luck, Dr. Ron!

ObamaCare Adds a New Tax and a New Tax Form for Employers

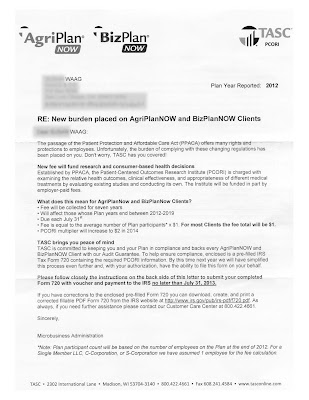

Above (click to enlarge and be able to read): Letter from Section 105 Plan Administrator informing me of even more ObamaCare fees and complex and convoluted IRS forms that are due 7/31/2013 (2 weeks after I received this paperwork).

I just received this in the mail yesterday: More fees and paperwork, attributed by my 105 Plan Administrators (AgriPlan BizPlan) to the passage of ObamaCare. They inform me that the burden of complying with ObamaCare is being placed on me, the employer. ObamaCare is collecting a fee from me, the employer, to pay the Patient-Centered Outcomes Research Institute (PCORI). The fees paid to PCORI go towards examining various medical treatment outcomes. The fees are due by 7/31/2013.

Above (click to enlarge and be able to read): Just one single page (out of 7 pages total) of complex and convoluted IRS forms that are due 7/31/2013 (2 weeks after I received this paperwork).

I randomly scanned just one page of these 7 IRS form pages, just so you get a sense of how much additional administrative time and burden this places on my 2 employee business. My estimate to complete this paperwork is about 2 hours, but hopefully less.

*****Update 2013/07/03

ObamaCare Delayed for Employers with 50 or More Employees from 2014 to 2015

Right before the major 4th of July holiday weekend (while Congress was in recess), a minor Treasury Department official casually posted on their web site that the Employer Mandate (this type of move is called in Washington DC "taking out the trash"), a key provision of the Affordable Care Act, would be delayed for a year. Note that this moved the provision past the 2014 midterm elections, and presumably delays the harm to the election results for the Dems.

Obama officials tried to pin the delay on businesses not being ready - leaving out the fact that they weren't ready only because the final rules had not yet been published by the Obama administration. This, despite the fact that only 6 months remained until implementation of ObamaCare, which was passed into law way back in 2010. They've had 3+ years to come up with some understandable rules for businesses, and they have not been able to do that, it would seem.

Let's hear from the Left: A quote from the Huffington Post Article that explains this delay (17,000+ comments on this article!):

Employers who don't provide health insurance will be spared penalties of up to $3,000 per worker until 2015, a one-year delay of a major component of President Barack Obama's health care reform law, the Treasury Department announced Tuesday.

Under Obamacare, companies with at least 50 full-time employees are required to provide qualifying health benefits to workers or face financial penalties called "shared responsibility payments." The provision of the law aims to shore up and strengthen the system that provides health benefits to most covered Americans. Under regulatory guidance to be published next week, the Obama administration will free companies from this mandate and from rules that they report information about their health benefits to the federal government next year.

Let's hear from the Right: A quote from the Townhall at Townhall.com that explains this delay (only 369 comments on the Townhall article). This is something that I also wondered about - how can they just change the law's implementation dates?:

Speaking of on-the-fly decisions, the law's language clearly sets an implementation date for the employer mandate, which the president is simply ignoring. Do presidents now have the power to ignore, delay, waive, or suspend significant portions of democratically-enacted laws, at least in part to address rank political concerns?

*****Update 2013/06/10

Where Have We Been and Where Are We Going?

Health Care Reform for Employers

The Strategic EMPLOYER newsletter, December 2012, page 3 -7. See the Waag and Co. Employment Law web site for more information. If you can understand ObamaCare, then you are way ahead of me.

by Kenneth W. Ruthenberg, Jr.

Ken Ruthenberg is an attorney with the Folsom, California employee benefits law firm of Chang, Ruthenberg & Long. Since its formation in 1989, the firm has focused exclusively on employee benefits law, representing employers in the private sector, not-for-profit organizations, and governmental employers, ranging in size from one person to over 50,000 employees. In addition to counseling clients and their other advisors, the firm represents clients in matters involving the IRS, the U.S. Department of Labor, and the Pension Benefit Guaranty Corporation. Ken has practiced employee benefits law exclusively for over 30 years, is a former chairman of the Employee Benefits Committee of the Taxation Section of the State Bar of California, co-founded the Sacramento Chapter of the Western Pension & Benefits Council, and is a fellow of the American College Of Employee Benefits Counsel. More information about Ken and the law firm can be found at www.seethebenefits.com.

Editor’s Note: The health care reform law know as “ObamaCare” was signed into law in March, 2010. However, the law’s various provisions are scheduled to go into effect incrementally over many years. Employers need to pay close attention to the law’s provisions as the full impact of ObamaCare approaches.

This health care legislation is complex and not yet fully defined and understood, and compliance with it will be a challenge for many employers.

As an employment law firm that does not give direct advice on ObamaCare compliance issues, Waag and Co. turned to an expert attorney in the field of health care law related to employers: Kenneth W. Ruthenberg, Jr., Esq. of the law firm Chang, Ruthenberg & Long. Mr. Ruthenberg was kind enough to pen this article to assist our clients in understanding where to begin in managing the requirements of ObamaCare and how to plan as we go forward into 2013, 2014 and beyond.

We recommend that employers seek out advice from qualified legal counsel such as Mr. Ruthenberg to understand ObamaCare and determine the best way to meet the needs of their business while complying with the law.

Once that is determined, Waag and Co., as always, is ready and available to assist employers with employment law issues that may be related to implementing your ObamaCare strategy, such as staffing levels, temp agency staffing, labor contracting, wage and hour laws, etc. We hope that Mr. Ruthenberg’s article below will provide a helpful start to your planning process.

Introduction

The United States Supreme Court has spoken — the new health care reform laws (passed under the name “Patient Protection and Affordable Care Act” or “PPACA” or simply “ACA”, also commonly known as “ObamaCare”) are constitutional — mostly. Now what? If you have not done so already, it's time for you to address your company's group health plans.

This article presents an overview of some of the more important issues that employers should have already addressed, ought to be addressing at this time, and will need to address in the years to come.

Small Employer Tax Credit

Starting in 2010, small employers may be eligible for a federal tax credit for a portion of their health insurance premiums (in lieu of a tax deduction up to the amount of the credit). A small employer is an employer that employs no more than 25 full-time equivalent employees with average compensation not greater than $50,000. A “full-time equivalent” employee is one who works 30 or more hours per week. The small employer must offer a qualified health plan to its employees and pay at least 50% of the premiums. Starting in 2014, the insurance must be offered through an exchange and the credit period is limited to two consecutive taxable years.

Over-The-Counter and Prescription Drugs

Effective for taxable years beginning after December 31, 2010, a reimbursement for a medicine or drug is excludable from an employee's gross income only if the medicine or drug is a prescribed drug (determined without regard to whether it is available without a prescription) or insulin.

Effective for taxable years beginning after December 31, 2012, an employer is not able to deduct prescription drug expenses to the extent that the employer receives a subsidy under the Social Security Act that is not included in the employer's gross income because the employer has a “qualified retiree prescription drug plan.”

Prior to health care reform, such an employer was able to receive the tax-free subsidy and claim an income tax deduction for the prescription drug expenses.

Cafeteria Plans

Effective for taxable years beginning after December 31, 2010, an eligible employer can adopt a simple cafeteria plan to avoid cafeteria plan nondiscrimination testing. An employer is eligible if the employer employed an average of 100 or fewer employees during either of the two preceding years. The plan must be offered to most employees and the employer must make minimum contributions to the plan for certain employees.

Effective for plan years beginning after December 31, 2012, a cafeteria plan offering a health flexible spending arrangement (“FSA”) must provide that an employee may not elect (for any plan year) to have salary reduction contributions to the FSA in excess of $2,500 (as adjusted for inflation).

Form W-2 Reporting

Employers must report the aggregate cost of employer-sponsored health coverage provided to employees on each employee's Form W-2 starting with the 2012 Form W-2 (reporting for 2011 was optional).

However, reporting for an employer that files fewer than 250 Forms W-2 for the previous calendar year is not required until further notice from the IRS. Although each employer should review the reporting guidance that can be found on the IRS's web site at www.irs.gov/uac/Form-W-2-Reporting-of-Employer-Sponsored-Health-Coverage, employers should note that:

• The most common types of coverage that must be reported are major medical coverage, the employer's portion of a health FSA, and dental coverage and vision coverage if they are not excepted from the reporting requirement (see next bullet).

• The most common types of coverage that need not be reported are the employees' compensation reduction portion of a health FSA, dental coverage and vision coverage if:

(i) they are under separate insurance policies if they are fully insured, or

(ii) if they are self-insured, participants are able to elect the coverage separately from the major medical benefits and pay an additional premium for the dental and vision coverage, and employer contributions to health savings accounts (“HSA”s).

• The cost of the coverage includes both employer and employee contributions and is determined using one of three methods:

(i) the COBRA applicable premium method,

(ii) the premium charged method for insured plans, or

(iii) the modified COBRA premium method.

• Just because an amount is reported on Form W-2 does not mean that the amount is taxable to the employee —these benefits can generally be provided on a tax-free basis — this reporting is for informational purposes only.

Medical Loss Ratio (“MLR”) Rebates

The MLR rules require an insurance company that does not spend enough of the premiums that it receives on health care and quality-improving activities to rebate a portion of the premiums to the policyholder. The first MLR rebates should have been received by August 1, 2012. The policyholder must then decide how to use the rebate, which depends on: (i) how much of the premium is paid by the employer and how much by the employees, (ii) whether the plan is subject to ERISA, and (iii) whether the policyholder is the employer, the plan itself, or a trust.

The failure to use an MLR rebate as required could result in adverse consequences to the policyholder and the group health plan's fiduciaries. The employer must also consider the tax consequences of the rebate for itself and for each employee, and comply with the applicable tax reporting requirements.

Group Health Plan Coverage Requirements

The health care reform laws contain a number of requirements for group health plan coverage. For example, the new laws require providing preventive care on a no-cost-sharing basis, covering adult children until age 26, giving at least 60 days’ advance notice of any material coverage modification, following new claims review procedures, and providing a Summary of Benefits and Coverage (“SBC”) explanation. Note that plans need to provide a compliant SBC with the open enrollment materials for plan years beginning on or after September 23, 2012.

They also contain a number of prohibitions. For example, they prohibit pre-existing condition exclusions and lifetime / annual limits on essential health benefits, as well as discrimination by fully-insured group health plans in favor of highly compensated employees. These nondiscrimination rules are based on the existing nondiscrimination rules for medical expense reimbursements that are not fully insured. However, the government has put these new nondiscrimination rules on hold pending the issuance of guidance telling us how the new rules are going to work.

It is possible that not all of an employer's health plans are subject to these rules. For example, “grandfathered” group health plans —those that existed on March 23, 2010 and satisfy certain other requirements — are not subject to some of these rules. Also, certain stand-alone dental and vision benefits and retiree-only health plans escape some of the rules.

It is important for each employer to determine which plans are subject to the new rules and to make sure that each such plan complies with them. Employers are subject to penalties if their group health plans violate the new laws.

Additional Medicare Taxes

Effective January 1, 2013, an additional Medicare tax is imposed on employees (not employers) who earn more than a set amount, as determined by their income tax return filing status. The tax is 0.9% and it applies only to wages in excess of (i) $250,000 if the employee is filing a joint return (based on the combined wages of the husband and wife), (ii) $125,000 if the employee is married and filing a separate return, or (iii) $200,000 for all other employees.

The employer is responsible for withholding the additional 0.9% on wages in excess of $200,000 only. Note that “wages” means “all remuneration for employment” unless specifically excepted under the Internal Revenue Service Code, including “wages” not received in cash (e.g., certain noncash fringe benefits, group-term life insurance in excess of $50,000, and amounts deferred under a nonqualified deferred compensation plan).

Exchanges

Health insurance exchanges are a keystone to health care reform. By January 1, 2014, each State is supposed to establish an exchange, or else the federal government will establish a federally facilitated exchange.

What is an exchange? An exchange is an entity established by a State or the federal government to help individuals and certain employers purchase health insurance coverage, as well as perform a number of other functions under the health care reform laws.

By March 1, 2013, each employer that is subject to the Fair Labor Standards Act (“FLSA”) must provide notice to its current employees that:

(i) informs the employee of the existence of a health insurance exchange, where health insurance coverage can be purchased, including a description of the services provided by the exchange, and the manner in which the employee may contact the exchange to request assistance; (ii) alerts the employee to the possibility of eligibility for a premium tax credit or a cost-sharing reduction if the employee purchases a qualified health plan through the exchange and the employer plan's share of the total cost of benefits under the plan is less than 60%; and (iii) explains that an employee who purchases a qualified health plan through the exchange may lose the employer contribution (if any) to any health benefits plan offered by the employer and that all or a portion of such contribution may be excludable from the employee's income for federal income tax purposes. The employer must then also provide the notice to new employees at the time of hiring.

Beginning in 2014, a small employer can offer coverage through an exchange. An employer is a small employer if the employer employed an average of not more than 100 employees (50 employees if the State changes the definition) on business days during the preceding calendar year.

Beginning in 2017, a large employer can offer coverage through an exchange. An employer is a large employer if the employer employed an average of at least 101 employees (51 employees if the State changes the definition) on business days during the preceding calendar year. If an employer offers coverage through an exchange, the employees can use the employer's cafeteria plan to pay exchange premiums.

“Play or Pay” Penalty

Beginning in 2014, a large employer may be subject to a penalty if the employer does not provide minimum essential health coverage to its full-time employees. Employers should familiarize themselves with the new law in 2013 so that they know how it will impact them in 2014 and beyond.

Who is a large employer? An employer is a large employer for a year if the employer employed an average of at least 50 full-time employees (at least 30 hours per week) on business days during the preceding calendar year. In order to make this determination, the employer must not only count all of its full-time employees, it must count the hours worked by its part-time employees for each month and divide this total by 120 in order to determine its “full-time equivalent” employees for the month.

An employer that has “seasonal workers” may be able to use a special rule for avoiding large employer status. It provides that an employer is not considered to employ more than 50 full-time employees if: (i) the employer's workforce exceeds 50 full-time employees for no more than 120 days during the calendar year; and (ii) the employees in excess of 50 employed during that 120-day period were “seasonal workers.”

What is a “seasonal worker”? A “seasonal worker” is a worker who performs labor or services on a seasonal basis as defined by the Secretary of Labor. They include workers whose employment pertains to or is of the kind exclusively performed at certain seasons or periods of the year and that may not be continuous or carried on throughout the year. They also include retail workers employed exclusively during holiday seasons. A reasonable, good faith interpretation of who is “seasonal” is all that is required through at least 2014.

Note that the exception is worded in terms of “more than 50 full-time employees,” but an employer is a large employer if it employees an average of “at least 50” full-time employees. We would welcome guidance from the government on this difference. For example, if an employer has 30 full-time non-seasonal employees, and 20 full-time seasonal employees for no more than 120 days, is this exception unavailable?

The IRS has provided detailed guidance and safe harbor methods for counting employees. The guidance includes the use of measurement periods for making “full-time employee” determinations, stability periods for using the results from a measurement period without having to reexamine employees whose hours might have changed, and the treatment of new employees. See IRS Notice 2012-58 at www.irs.gov/uac/Affordable-Care-Act-Tax-Provisions.

What coverage must the employer offer? The employer's coverage must be affordable to the employees and provide minimum value to the employees:

• A group health plan is not affordable if the employee's self-only coverage premium exceeds 9.5% of the employee's household income (the percentage will be indexed for inflation). An employer cannot make this determination without knowing a great deal of financial information about its employees. The penalty provision is structured so that this determination is made by the U.S. Department of Health and Human Services (“HHS”) or an exchange in cooperation with HHS.

• A group health plan does not provide minimum value if the plan's share of the total allowed costs of benefits provided under the plan is less than 60%. We are awaiting guidance from the government on how to make this determination.

The IRS has mentioned the HHS's creation of a calculator, the use of design-based safe harbor checklists, and an actuary's certification. Pending additional guidance, employers should work with their group health plan advisors to determine if this requirement is satisfied by their group health plans.

When is the penalty triggered? The penalty is triggered if, and only if, HHS or an exchange in cooperation with HHS has certified to the employer that at least one full-time employee has enrolled in an exchange with respect to which a tax credit or cost-sharing reduction is allowed or paid with respect to the employee.

That is, because either:

(i) the employer did not offer minimum essential coverage to its full-time employees (need not offer such coverage to the part-time employees); or

(ii) the coverage offered was not affordable or did not provide minimum value.

Note that an employee who enrolls in an employer's group health plan has minimum essential health coverage and is not eligible for the premium assistance credit, even if the plan is not affordable or does not provide minimum value.

What is the penalty? It depends on the failure involved. If a large employer fails to offer all (or substantially all) full-time employees the opportunity to enroll in minimum essential health coverage under an eligible employer-sponsored plan for a month, the penalty for that month is equal to the product of the number of full-time employees for the month minus 30 x $2,000 x 1/12.

If, however, a large employer offers full-time employees the opportunity to enroll in minimum essential health coverage for a month but the coverage is not affordable or does not provide minimum value, the penalty for that month is equal to the product of the number of full-time employees for the month who have been certified by HHS x $3,000 x 1/12, not to exceed the penalty that would have applied if the employer had not offered minimum essential health coverage under an eligible employer-sponsored plan (above).

Automatic Enrollment

An employer that is subject to the FLSA and has more than 200 full-time employees must automatically enroll new full-time eligible employees in one of the employer's group health plans and continue the enrollment of current participants.

The employer or the administrator must also provide adequate notice to the employees of such automatic enrollment and the opportunity for an employee to opt out of any coverage in which the employee was automatically enrolled.

We are currently awaiting guidance from the DOL on this new requirement, including when it will become effective (likely in 2014). We will also have to see how this new requirement meshes with the cafeteria plan rules under the IRS Code.

Cadillac Tax

Beginning in 2018, an employer or an insurer may be subject to a penalty tax for providing high-cost health coverage to employees. The penalty tax is 40% of the “excess benefit,” which is the cost of the employer's group health coverage in excess of certain statutory limits.

What To Do Now?

Employers, along with their insurers, group health plan service providers and other advisors, need to make certain that their group health plans comply with the health care reforms currently in effect and that they will comply with those that become effective in the future.

The process starts with inventorying your group health plans, determining which laws apply to each of the plans, and analyzing whether each plan is (or will be) in compliance with the new laws.

Because of the complexities presented by health care reform laws, we encourage employers to seek advice from an attorney who is knowledgeable about the new laws. Employers should also be on the watch for additional guidance from the government about what the new laws mean and how to comply with them.

*****Update 2013/06/08 - Money Magazine (July 2013 edition) reports on page 15 that a recent John Hopkins study shows that if doctors are shown the bill for medical tests that they order, they will then order 9.6% less tests. However, the reality is that doctors are NOT shown the costs for the tests, because nobody even knows how much they cost - including the doctors and hospitals! Information leads providers to be more cost-conscious.

We've always objected to how the medical system deals in Funny Money, and is separated from economic reality by providers and users. This study is a great example of that. By the way, I went online and could NOT find that study...go figure!

*****Update 2013/05/30: - Just got this letter from Blue Shield in the mail today. It explains 2 ObamaCare taxes that I had never heard of before, even though I have edited numerous articles for law firm newsletters on the subject. The 2 new taxes are:

(1) Health Insurer Tax: 2.3% percent of our health insurance premium

(2) Transitional Reinsurance Contribution Program Tax: 1.3% of our health insurance premium.

The letter goes on to state that our (already INSANELY expensive) health insurance premium from Blue Shield of California will increase by the amount of these taxes. ObamaCare news just keeps getting better and better: hold onto your wallets, people!

*****Update 2013/05/29 (The Strategic EMPLOYER newsletter, December 2012, page 1)

ObamaCare and the California Legislative Supermajority 2013

By Tim Waag.

This newsletter [The Strategic EMPLOYER newsletter, December 2012, page 1] gives extensive coverage to the ever-increasing demands placed upon employers by the health mandate commonly referred to as “ObamaCare”. Thanks to benefits attorney Ken Ruthenberg of Chang, Ruthenberg & Long, we are covering “where we have been and where we are going” for employers that are still trying to provide affordable health care coverage to their employees. We normally do not devote this much space to coverage of a single subject, but anything that dramatically changes one-sixth of our entire U. S. economy cannot be ignored or glossed over.

Not being health care benefit experts, Waag and Co. is just as anxious as our clients and friends when it comes to understanding what ObamaCare may be foisting upon us. The legislation underlying the mandates is complex, technical, and often obscure. This newsletter, unfortunately, is only able to serve as a starting point for helping you and your business to sort it out.

A less talked-about change of dynamics for 2013 has to do with our new Democrat supermajority in the California state Legislature. Democrats have unrestricted, unchecked power in the executive and the legislative branch, and all the responsibility (and blame) that goes with it.

Since it takes two-thirds of the California Legislature to enact a variety of important legislation, the Republicans have for years been able to easily frustrate Democrat ambitions. With Democrat victories in the November 2012 election, there is now an unfettered shift in power.

Many expect a full-out assault on the taxpayers of California, while others hope that restraint is the order of the day. Either way, Democrats will own 100% of whatever direction is taken.

Democrat leaders are facing years of pent-up desire among their grassroots supporters to roll back spending cuts, rebuild the state’s water system, amend the state’s tax code, revamp California’s governance system and more. We’ll just have to wait and see what happens. It should be an interesting year for California businesses.

*****Original Article - I've been discussing ObamaCare recently with friends. Below are a few notes from that discussion, followed by an article that appeared in the newsletter, The Strategic EMPLOYER. As with most contentious issues, we are discussing not certainty of outcome, but likelihood of outcome, if you can appreciate the difference. I am confused as to how insurers can come up with rates effective 1/1/2014, when it there is 7 more months of historical data to precede that date (see this Forbes article on the subject). We usually get our new health care rates shortly before they renew. Of course, time will tell, and it just feels like a crap-shoot to us.

I believe that ObamaCare may just be a clever precursor to a Single Payer System, which, believe or not, I favor over ObamaCare by a wide margin. Single payer can be implemented in many different ways, so it would depend on the details of implementation as to whether I'd like it or not. The main reason is that Single Payer has one thing that ObamaCare does not - understandability and simplicity. The reason that "no one really knows what is going to happen to costs, they're all SWAGs" should scare us, not encourage us - since we are talking about health care making up about one sixth of the national GDP! Single payer is an incredibly simpler system, and one assumes that it would also be easier to estimate those costs to the US citizens.

I actually believe that health care should be disconnected from employment - the reasons are obvious. Employers got into health care during the wage freezes of WW II, as it was a way to increase pay during the freeze. Its been connected to employment ever since. Decoupling health care from employment makes sense to me, but will never ever happen, of course (because it makes too much sense). People buy most insurance themselves (auto, life, disability, homeowner's, umbrella, diver's alert network scuba insurance, renter's, business liability, malpractice insurance, etc.), so why not health insurance? Yes, I know that employers offer token life and disability insurance and perhaps other insurance, but only token coverage - not all that is required. That way, your health insurance goes with you no matter where you work - you can change jobs because quality health insurance does not force you to stay where you are.

A friend writes:

"Honestly, no one really knows what is going to happen to costs, they're all SWAGs. That's why the Forbes article [see above link - same as this link] was so interesting to me, it is the first real life example of what is starting to happen (as opposed to all of the predictions from the talking heads). Health care costs have been rising at 5-10% per year for more than a decade, so I'm not sure that we can blame cost increases on the ACA.

The ACA hopes to "bend the cost curve" but I think we're several years from that, and that is the part that I am most skeptical about. We haven't yet made the hard decisions that result in costs going down. Right now, we are expanding coverage, putting much needed restrictions on insurance companies, and providing mechanisms like the exchange (Covered California) to make the market more efficient.

Although we may disagree, I have no problems with giving employers carrots and sticks to expand employee health coverage. Employer based health coverage is the legacy that we have from World War II, so we either replace it, or make it work better. The replacement would likely be a government run single payer health system, so I'm not sure that you would like that any better (nor would I).

Finally, there will be many, many plans on the exchange. The three plans (actually four) that you found are referred to as "metal tiers" They are platinum, gold, silver and bronze and actuarially are required to pay for 90, 80, 70 and 60% of antcipated costs respectively, Within each of those tiers, there will be many different plans from different insurance companies offering many permutations of co-pays, co-insurance, and variable coverage for drugs, outpatient care, and hospitalization that you will choose to suit your needs best.

The metals tiers are only there to provide "transparency" so that you can better compare plans The federal government will provide decreasing subsidies up to four times the federal poverty level, which is currently $90K for a family of four."